CHARLOTTE, N.C., Nov. 17, 2020 -- Thirty Capital Financial's SOFR With Ease™ announced the launch of its newest web-based interest rate cap calculator tied to SOFR. SOFR With Ease is an advisory service firm that offers expert interest rate hedging services and assists commercial real estate customers in navigating the transition from LIBOR to SOFR.

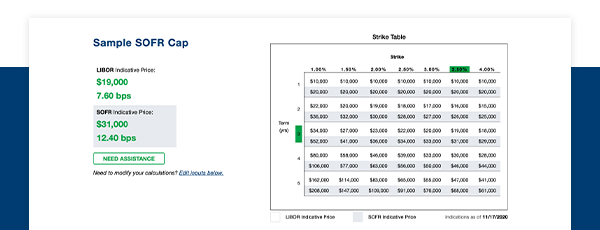

The new online calculator is the first and only SOFR cap calculator created. It is available as a free tool on their website. Users of the calculator can receive an indication of a current SOFR Rate Cap and a side-by-side price comparison to a LIBOR Cap instantly.

SOFR caps have become more prevalent in the commercial real estate market. While agency lenders like Fannie Mae and Freddie Mac are currently providing floating rate loans tied to SOFR, it is anticipated that many bank lenders will follow suit in the coming months. The SOFR With Ease team recognized the urgency to provide a tool for the industry that meets the immediate needs of commercial real estate firms venturing into SOFR based loans that require SOFR interest rate caps.

"Currently, the majority of interest rate caps purchased in the market are still tied to LIBOR, but this trend will shift rapidly in the next few months. It is important that borrowers have a resource to quickly gauge the SOFR cap market and get approximations of cost as they structure transaction economics. Our new calculator will help users get a quick glimpse into current market pricing disparities between a LIBOR and SOFR cap and consult with our team of advisors for the best execution," said Chief Executive Officer Jeff Lee.

To access the first and only SOFR Cap Calculator, visit sofrwithease.com

About SOFR With Ease™

SOFR With Ease, a Thirty Capital Financial company, offers commercial real estate professionals the latest tools, news, and advice for the upcoming LIBOR to SOFR transition along with industry-leading execution and transparency for rate caps, swaps, among other interest rate hedging derivative products.